Sustainability Reporting: An Overview of GRI, CDP, SASB, TCFD, & UN SDG Frameworks

- FreeWorld

- Apr 15, 2021

- 5 min read

Updated: Apr 16, 2021

This post represents part #3 of the '5 Steps To A Business Sustainability Plan' E-Book. If you want to view the "5 Steps To A Business Sustainability Plan", click here.

For businesses, sustainability has never been more accessible, or more confusing.

As customers, investors, and businesses place growing importance on company reporting for ESG (Environmental, Social, Governance) factors, many companies lack the understanding of which ESG reporting framework they should use. Other challenges, such as competing frameworks, inconsistent sustainability metrics, and difficulty of comparing companies also hamper ESG reporting adoption.

Luckily, there are a few widely accepted reporting standards which help companies monitor the ESG impacts of their business, while also satisfying the demands of ESG investors and business stakeholders.

This article summarizes the prominent sustainability reporting standards, so you can choose the right framework for your business:

GRI

Established in 1997, the Global Reporting Initiative (GRI) is one of the oldest and most widely adopted sustainability reporting standards in the world. The GRI Standards represent global best practices for reporting publicly on a range of economic, environmental and social impacts. GRI reporting is considered modular, meaning that companies can choose to create sustainability reports using all, or selected parts of the GRI Standards. To simplify which parts of the GRI are most essential, the standards are split into two categories, Universal Standards and Topic Standards. When reporting with GRI, all companies include the three Universal Standards, and then can choose specific Topics Standards reflecting their most significant and material sustainability impacts.

GRI Standards focus on a broad and global audience. GRI was announced as the official reporting standard of the UN Global Compact, making it the default reporting framework for the Compact’s more than 5,800 associated companies. As evidence of GRI's wide applicability, public and private companies, cities, government agencies, universities, hospitals, and NGOs can all use the Standards.

There is no set timeline to report using the GRI Standards, but reporting is typically integrated into a company’s traditional annual report.

To address the problem of conflicting and overlapping reporting standards, GRI provides guidance for companies to incorporate their GRI reporting into several other reporting standards, including SASB, the UN SDGs, and CDP.

CDP

The CDP (formerly the Carbon Disclosure Project) holds the largest database of corporate greenhouse gas (GHG) emissions and energy use data in the world. CDP reporting is organized as an annual questionnaire which covers a range of ESG topics, with a focus on GHG emissions and other environmental impacts. CDP scores each organization based on questionnaire responses and provides a transparent scoring methodology so respondents understand exactly what is expected of them to achieve a high sustainability rating. As such, the CDP has been voted as the world’s most credible sustainability rating, and is supported by institutional investors representing more than $90 trillion in assets.

Each year, CDP takes the information from its annual reporting process and scores companies and cities based on their journey towards environmental leadership. When companies report using CDP, they receive two scores (0-100) representing their level of sustainability Disclosure, and sustainability Performance.

Because CDP compiles scoring for all companies using its Standards, companies must report on an annual schedule to be included in the CDP database. Currently, the reporting window runs from February - June of each year. The Carbon Disclosure Leadership Index (CDLI) recognizes top scoring companies based on the results of each annual reporting cycle.

CDP is widely applicable and can calculate sustainability of public and private companies, cities, government agencies, NGOs, and supply chains.

SASB

Established in 2012, the Sustainability Accounting Standards Board (SASB) provides industry-specific reporting metrics for public companies. The SASB Standards provide sustainability insights with focus on investors’ interests in U.S. companies and industries. SASB reporting is implemented into the company's SEC 10-K reporting.

SASB reporting is designed to help companies disclose financially material sustainability information to investors.

SASB realizes that not all sustainability issues matter equally to each industry. For this reason, the standards identify the subset of environmental, social, and governance (ESG) issues most relevant to financial performance in each of 77 industries.

SASB points out that disclosures are more effective when they are specific, and metrics without related discussion and analysis are not as helpful. Accordingly, SASB recommends companies combine metrics with narratives to enhance the accuracy and comparability of the data. To increase inclusivity and applicability of the Standards, SASB has produced several guides to incorporate SASB disclosures into other prominent reporting standards, such as GRI and TCFD.

Finally, for firms new to sustainability reporting, SASB provides a Materiality Map to help companies identify their most important ESG areas.

TCFD

In 2017, the international Financial Stability Board created the Task Force on Climate-related Financial Disclosures (TCFD) to improve and increase reporting of climate-related financial information.

TCFD reporting is designed to create useful and forward-looking information for business decision-making, which can be included in mainstream financial filings. The TCFD disclosures also help identify information needed by investors, lenders, and underwriters to appropriately assess and price climate-related risks and opportunities into their investments.

TCFD is structured around four core recommendations for sustainability reporting:

1) Governance

2) Strategy

3) Risk Management

4) Metrics and Targets

As companies progress through the core TCFD disclosures, the recommendations become increasingly specific and helpful for business decision-making:

1) Governance: Describes management's role in identifying and addressing climate-related risks and opportunities.

2) Strategy: Describes the breadth and impact of climate-related risks and opportunities identified by the company over the short, medium, and long term.

3) Risk Management: Describes the company's processes for identifying and managing climate-related risks.

4) Metrics and Targets: Describes company metrics used to quantify climate-related risks, discloses company greenhouse gas (GHG) emissions (i.e. carbon footprint), and identifies targets for the company to measure progress against climate-related risks and opportunities.

Alongside the core disclosures, TCFD outlines supplemental disclosures related to specific industries.

The TCFD was formed on the belief that one of the most significant, and most misunderstood, risks that organizations face today relates to climate change. This belief, combined with the financial crisis of 2007 - 2008, results in increased demand for transparency from organizations on their governance structures, strategies, and risk management practices.

Many industries are not yet feeling the effects of climate change. Because of this, TCFD provides scenario analysis guidelines to provide a way for organizations to consider how the future might look if certain trends continue or certain conditions are met. Companies can use the scenario analysis to identify implications of continuing business-as-usual, especially if they operate in industries with fixed or long-lived assets, locations in climate sensitive regions (i.e. coastal and flood zones), or if their operations or supply chain have high reliance on the availability of water.

TCFD is widely applicable and can help streamline the sustainability reporting process by including disclosures within a company's annual financial reporting.

UN SDGs

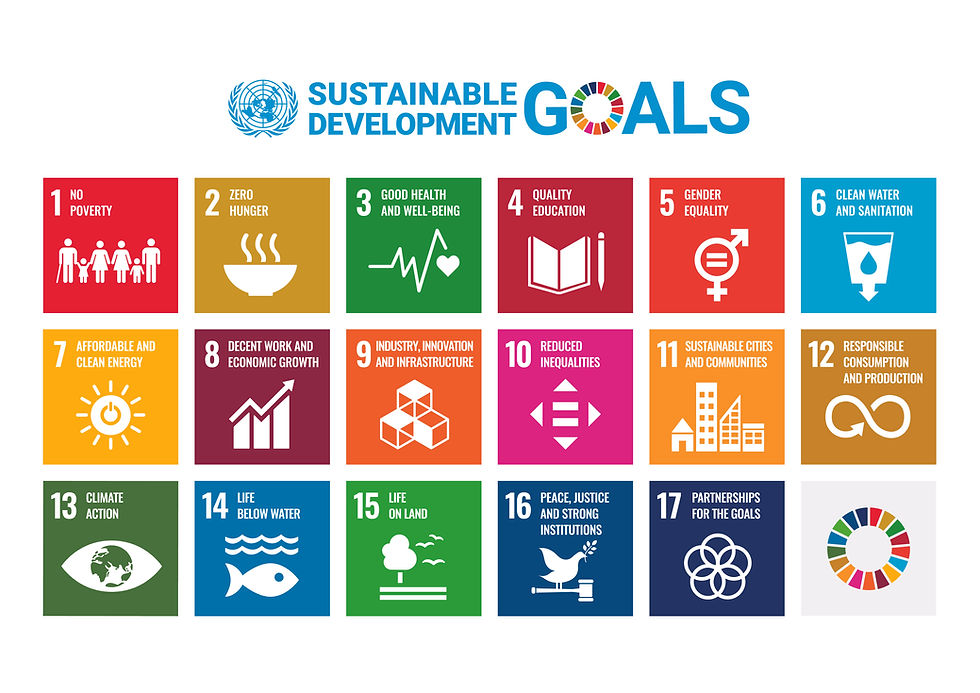

The United Nations' Sustainability Development Goals (UN SDGs) were agreed upon and enacted by all member states of the United Nations in 2015. The SDGs represent a 15 year agenda to end poverty, protect the planet, and improve the lives of everyone around the globe. While the SDGs are not "standards" for sustainability reporting, they represent a widely adopted blueprint for a more sustainable future.

The SDGs include 17 individual goals which address global challenges including poverty, inequality, climate change, environmental degradation, peace and justice, and more. Each SDG has numerous targets, metrics, and actions which, if achieved, will help to ensure the health of the planet and all people.

Progress towards the SDGs is compiled at a national level, and thus, the SDG agenda does not set out specific reporting standards for companies. Despite no formal disclosure guidelines, the SDGs can be mapped to all the major sustainability reporting standards, and provide effective context for corporate sustainability reporting.

Conclusion

In conclusion, sustainability reporting can provide context for business decision-making, clarity for clients and investors, and unity around company sustainability goals.

Each sustainability reporting framework helps companies disclose vital information, which can lead to greater operational efficiency and improved environmental and social awareness.

If your company is struggling to choose a framework, or would like to discuss options for improving business sustainability, we are happy to help.

We hope this article provides value for your organization, and helps you on your journey to do business as it should be done.

Comments